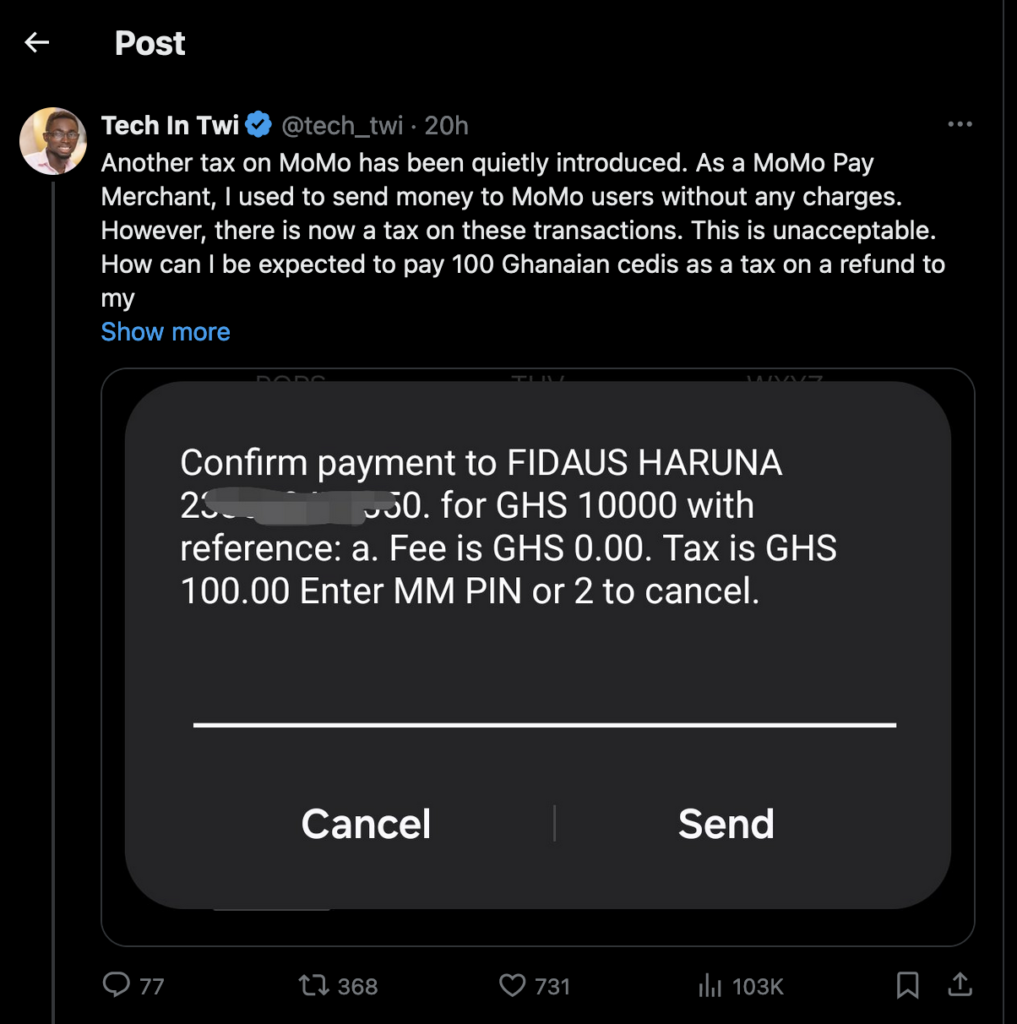

A recent post by @tech_twi on social media has ignited a debate over a supposed new tax applied to Mobile Money (MoMo) transactions in Ghana.

The user shared a receipt showing a GHC 10,000 transfer to one Fidaus Haruna, which incurred a GHC 100 tax, suggesting the introduction of a new levy on MoMo transactions.

“Another tax on MoMo has been quietly introduced. As a MoMo Pay Merchant, I used to send money to MoMo users without any charges. However, there is now a tax on these transactions. This is unacceptable. How can I be expected to pay 100 Ghanaian cedis as a tax on a refund to my customer?” he wrote.

The post, which has attracted significant attention with 77 comments, 367 retweets, 728 likes, and 102.8k views, has resonated with numerous MoMo users who have experienced similar charges.

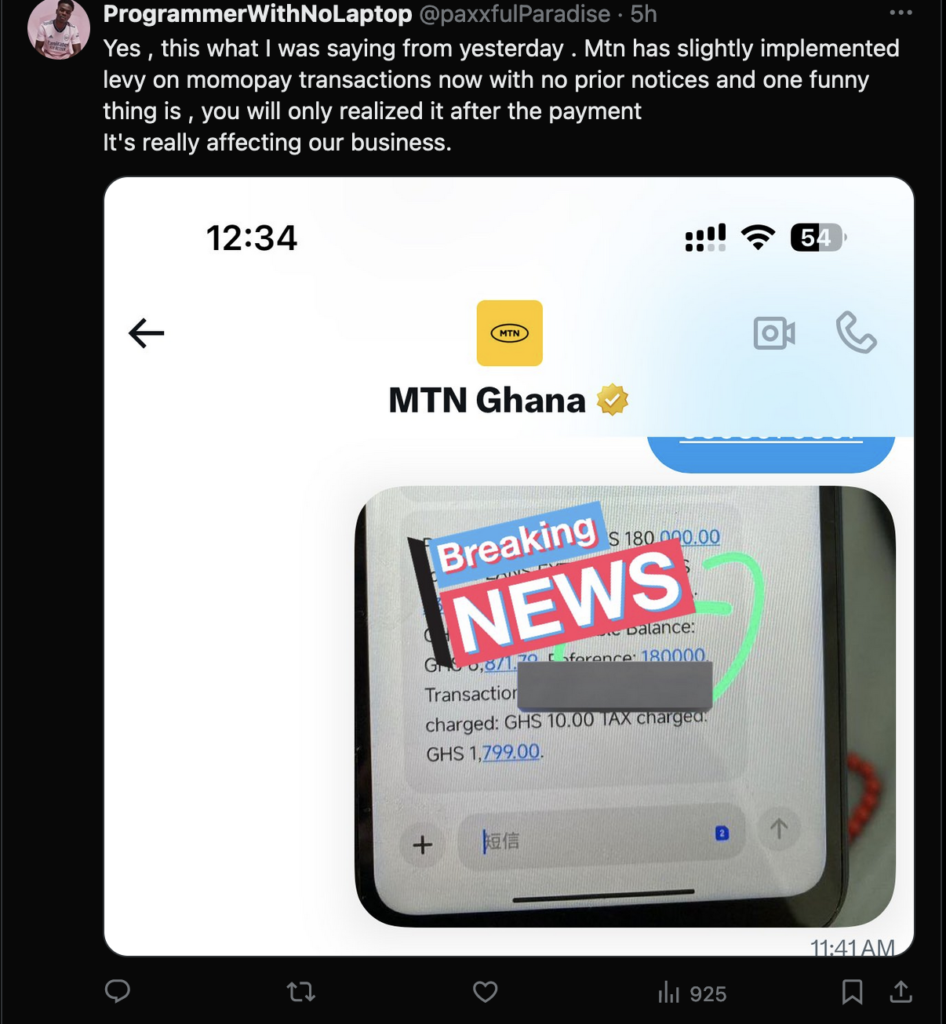

Users reported a range of taxes on their transactions, some as high as GHC 26,000, sparking widespread concern and discussion online.

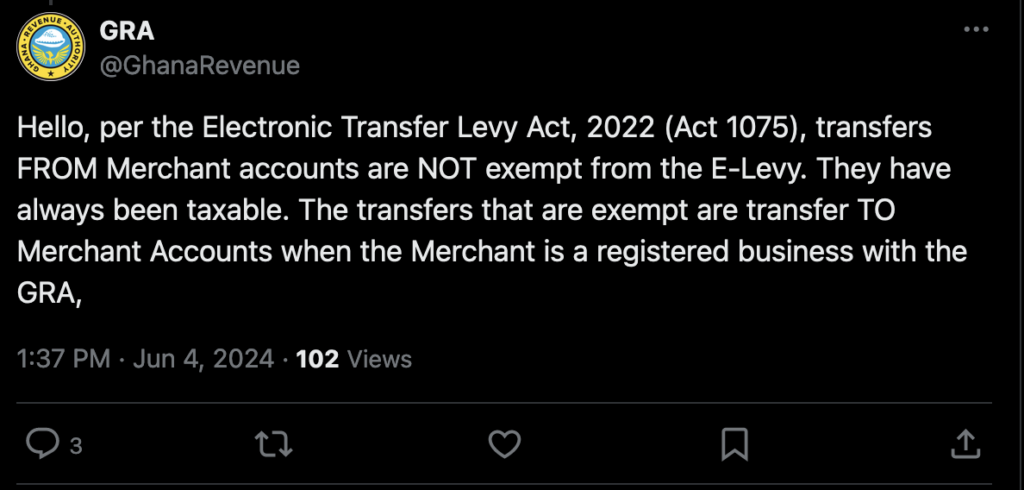

In response to the outcry, the Ghana Revenue Authority (GRA) clarified the situation, citing the Electronic Transfer Levy Act, 2022 (Act 1075).

According to the GRA, transfers from merchant accounts are subject to the E-Levy, as they have always been taxable under the act.

The exemption applies to transfers to merchant accounts when the merchant is a registered business with the GRA

The Electronic Transfer Levy, initially set at 1.5% on electronic transfers, was introduced as part of the government’s efforts to enhance revenue mobilisation by broadening the tax base.

However, the levy has been a subject of contention, with calls for its review and adjustment to ensure fairness and to stimulate compliance.

The MoMo tax has had a significant impact on both merchants and customers, with some merchants threatening to strike over the levy on merchant SIM cards.

Research suggests that the tax could be affecting the financial sustainability of businesses and the overall MoMo ecosystem.

As the discussion continues, stakeholders are seeking a balance between the government’s need for revenue and the financial well-being of the citizens.

The situation underscores the importance of clear communication and consultation in tax policy implementation to avoid confusion and ensure equitable taxation.